do travel nurses pay state taxes

My question is would ONLY the income earned in Ca. State travel tax for Travel Nurses.

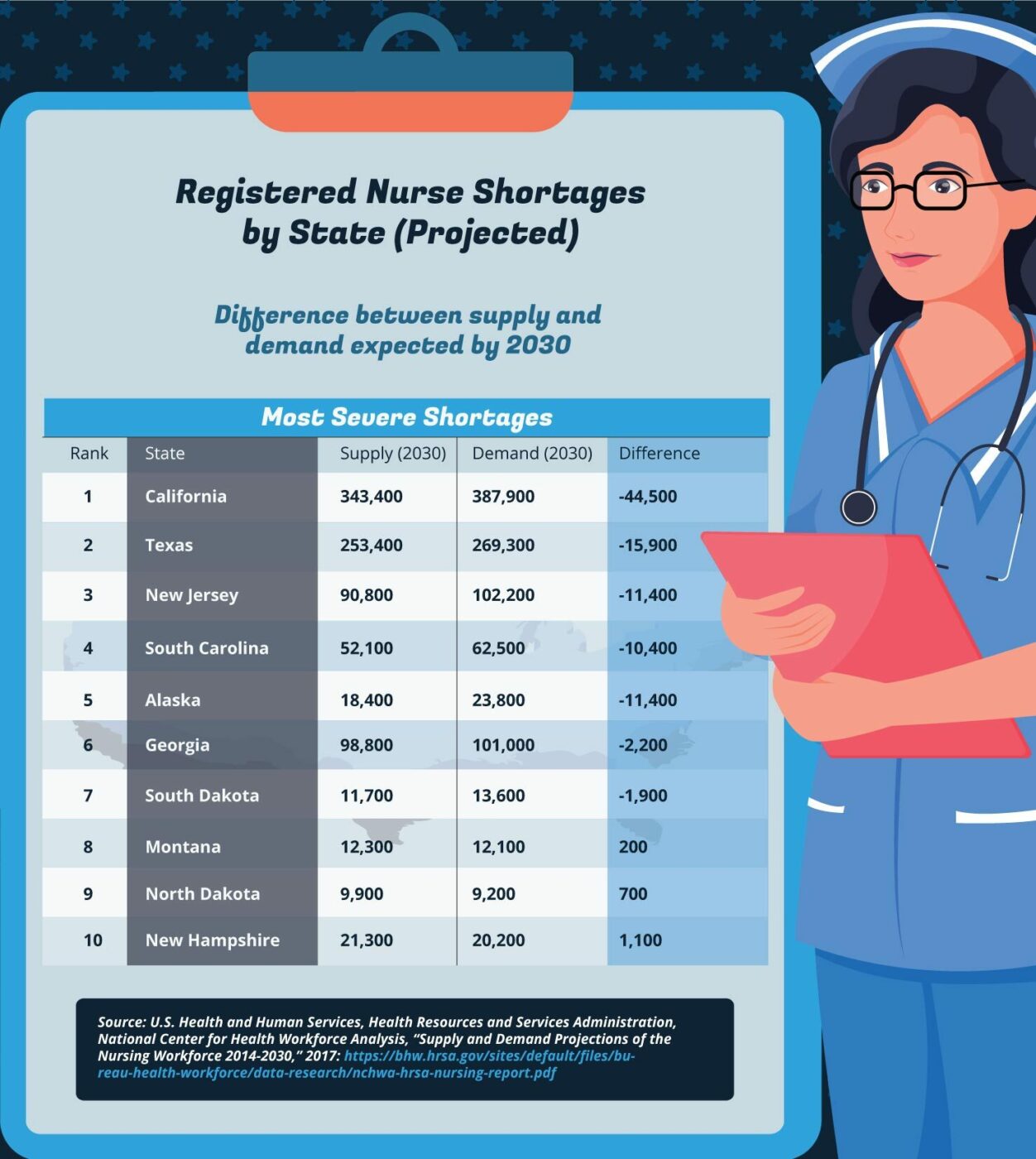

Travel Nurses Are In High Demand Are You Eligible To Travel Travel Nursing Travel Nursing Companies Nurse

250 per week for meals and incidentals non-taxable.

. The date to file your taxes by this year is Monday April 18 2022. Either way the faster you file the quicker you cash in on whatever refund you may have coming. Not just at tax time.

Tax deductions for travel nurses also include all expenses that are required for your job. Two basic principles are at work here. The fact that the income was not earned in the home state is irrelevant.

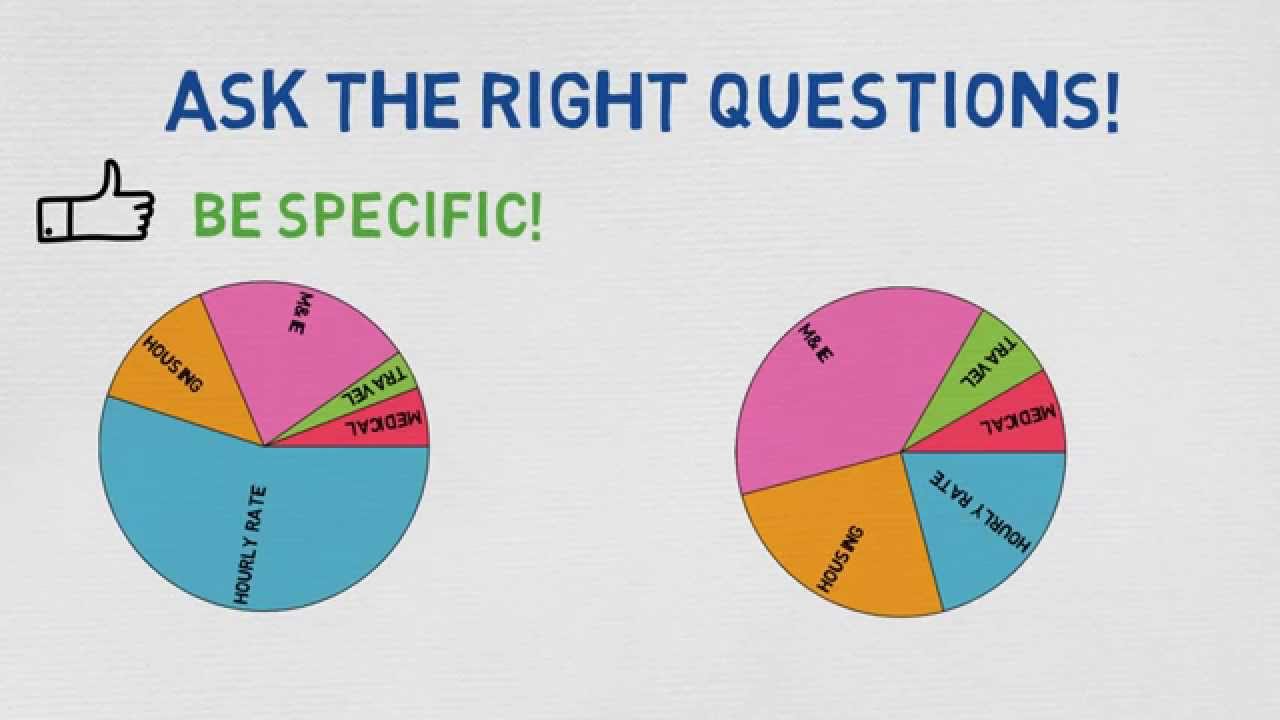

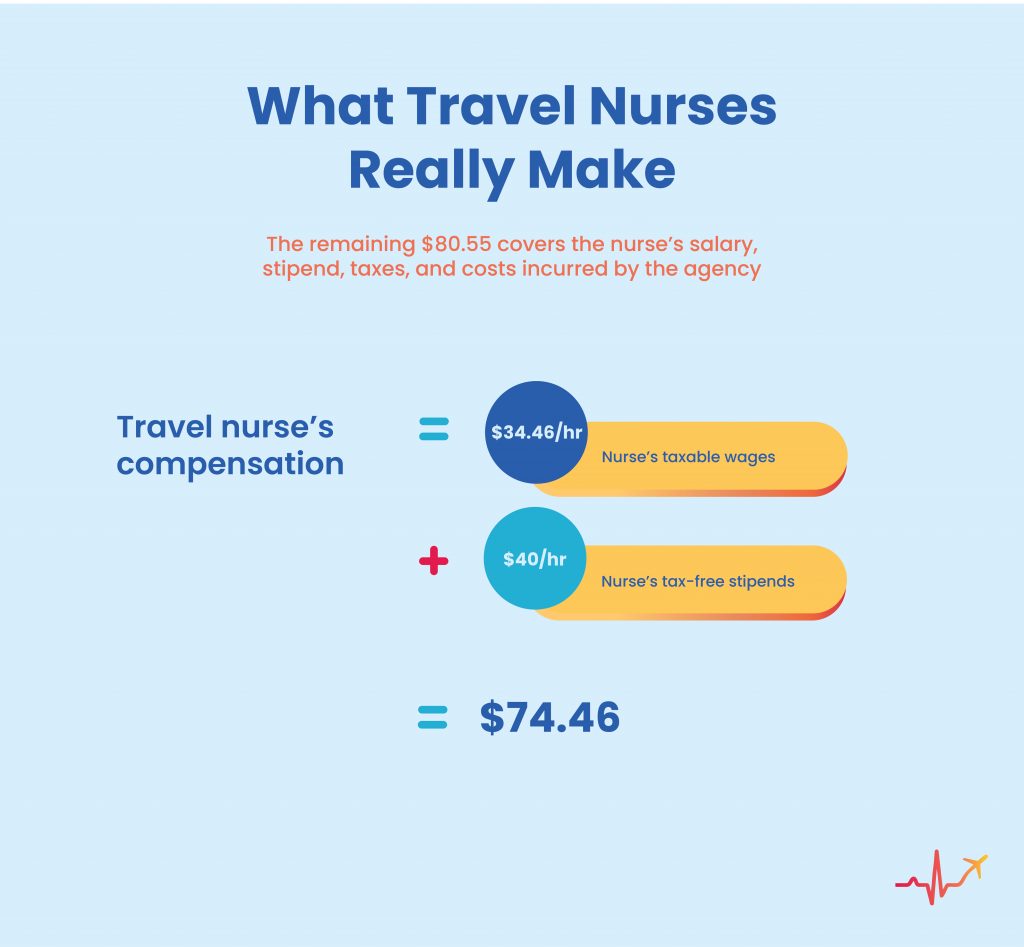

Travel Nurse Tax Tip 1. These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. 20 per hour taxable base rate that is reported to the IRS.

The expense of maintaining your tax home. You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable. Any phone Internet and computer-related expensesincluding warranties as well as apps and other.

For most travel nurses hourly wages will be reported on a W-2 form and subject to 1530 in payroll taxes. Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements. I could spend a long time on this but here is the 3-sentence definition.

There are at least 4 ways to fill this gap. 10 for the first 9875 in taxable income. You will need to pay three taxes as an independent contractor.

Make sure you have paperwork proving your start and end dates to prove temporary work. Here are some categories of travel nurse tax deductions to be aware of. Take a moment to read five travel nurse tax tips.

You will owe both state where applicable and federal taxes like everyone else. Some agencies will outright refuse to do this as it requires additional work to add a second state. This is how a lot of travel nurses handle taxes.

Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other. First your home state will tax all income earned everywhere regardless of source. 24 for taxable income between 85526 and 163300.

One of the many incentives medical companies may use to entice traveling nurses is through the use of per diems wages paid for daily living expenses such as food gas or other basic expenses. 500 for travel reimbursement non-taxable. When is the travel nurse tax deadline 2019.

12 for taxable income between 9876 and 40125. At the same time the work state will. But state law company policies and the terms of your travel nursing assignment contract may provide additional overtime pay and an increased holiday pay rate.

For general questions and answers on salary and open positions complete the form for a quick question call 800-884-8788 or apply online today. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient.

153 in self-employment taxes Social Security and Medicare. 1 A tax home is your main area not state of work. If they can this is the fastest way.

Typically there are stipends or reimbursements for travel nurses. State income taxes for. This means theyll have to calculate and remit all taxes to the IRS and state authorities.

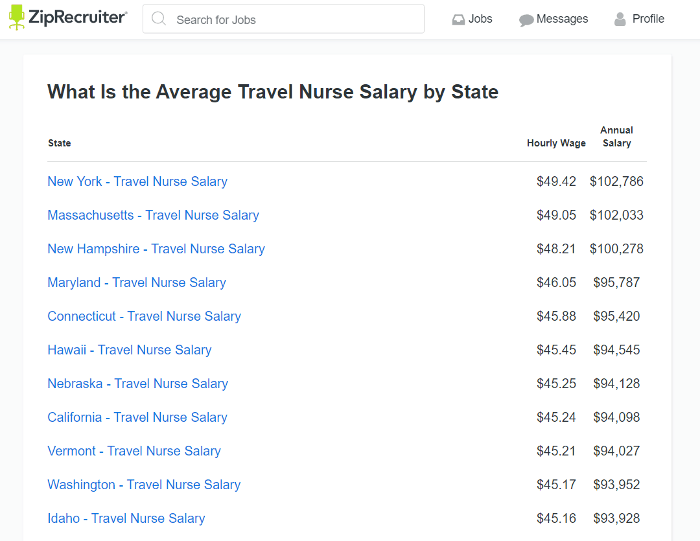

It depends on both your state of permanent residence and your state of employment. There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience. When doing proactive planning Willmann says its important to pay attention to your marginal tax rate.

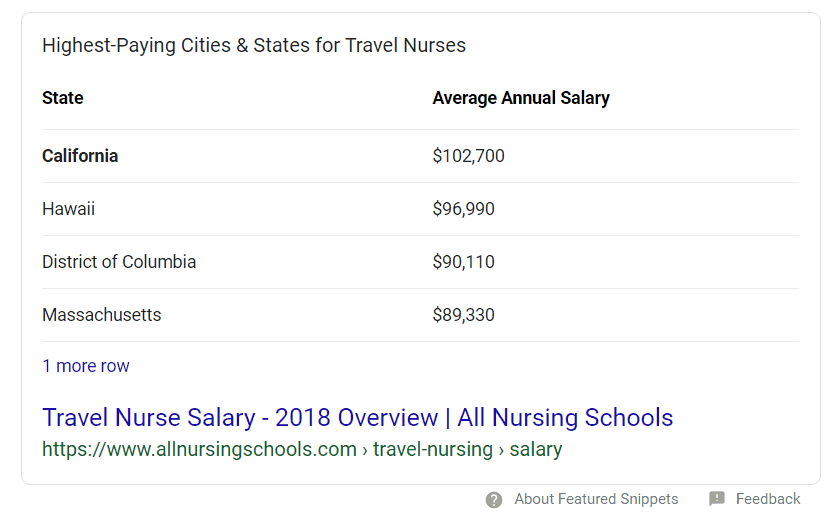

State income taxes or would my retirement pe. Here is an example of a typical pay package. What taxes do travel nurses pay.

22 for taxable income between 40126 and 85525. The costs of your uniforms including dry cleaning and laundry costs. Travel Nurse Tax Tip 2.

1 Ask your agency to withholding for your work state AND additional amounts for your home state. Those are required by the Federal Insurance Contributions Act FICA and fund. Your hourly wages are taxable but these per diems are not.

Tax break 3 Professional expenses. Do travel nurses pay state income tax in both the state they reside and the state where they work. Maintain a mileage Log and keep.

For W2 employees FICA tax of 153 of gross earnings is deducted from their paycheck to fund social security and medicare and their employer pays for half of the tax. Thats the tax rate on one more dollar of. You can file taxes yourself using IRS e-file or hire a tax professional to file for you.

Others can read this sites handy advice. This is the most common Tax Questions of Travel Nurses we receive all year. Im only going to address the issue of tax-free stipends aka per diems the IRS kind not the nurse shift kind for nurses who maintain and pay for another residence while temporarily on travel assignment.

There are a handful of important tax advantages to be aware of as a travel nurse primarily in the form of stipends and reimbursements. If your home state has a higher tax rate you have a gap to fill. It is time to file taxes for travel nursesIs everything in order with your recordsMonday April 15 2019 is the last day taxpayers may submit their returns for the 2018 tax yearYou have the option of doing your taxes on your own using IRS e-file or you may pay a tax expert to do it for youIn either case the sooner you.

Be subject to Ca. If after these Travel Nurse Tax Tips you still have any questions can help please check the IRS guide on travel expenses here. As you interview for and are offered travel nursing jobs pay close.

This is typically done in the form of an expense report. Some states have reciprocity agreements that dictate that travel nurses pay income tax to only one state while others do not. Travel expenses from your tax home to your work.

I live in Florida and receive a retirement pension form the military. Federal income taxes according to your tax bracket. Travel nurse income has a tax advantage.

Your blended rate is calculated by breaking down your non-taxable stipends into an hourly. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals. Companies can reimburse you for certain expenses while working away from your tax home.

A 1099 travel nurse handles all their documentation and taxes themselves. 2000 a month for lodging non-taxable. These will make filing taxes at the end of.

Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax. Resources on tax rules for travelers and some key points. Hi there I am considering travel nursing to California but I do not know how the state income tax works there.

Keep hard copies of all contracts and paperwork. Reimbursements are business-related expenses that you have paid for out-of-pocket that your employer pays you back for.

What Is Travel Nursing Academia Labs

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Salary Comparably

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Wanderly 7 Steps To Becoming A Travel Nurse Healthcare Jobs Travel Nursing Nurse

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Understanding Pay Packages For Traveling Nurses 2021 Marvel Medical Staffing

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nurse Insight What Goes In To Pay Packages

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

How To Make The Most Money As A Travel Nurse

Learn All You Need To Know About Working As A Travel Nurse In The United States With This Infograp Nursing Programs Accelerated Nursing Programs Travel Nursing

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing